Disciples Church Extension Fund inspires and empowers congregations to create Holy Places where people connect with God, each other and the community.

Through investments, loans, and building and capital planning resources, Disciples Church Extension Fund is here to help congregations thrive and transform communities.

Already a DCEF investment client?

Manage your account online.

Log in now

Plan

Disciples Church Extension Fund is your expert partner in planning your church’s future. From building planning and evaluation services to relocation and architectural guidance, our knowledgeable staff is here to help you maximize your financial and other resources.

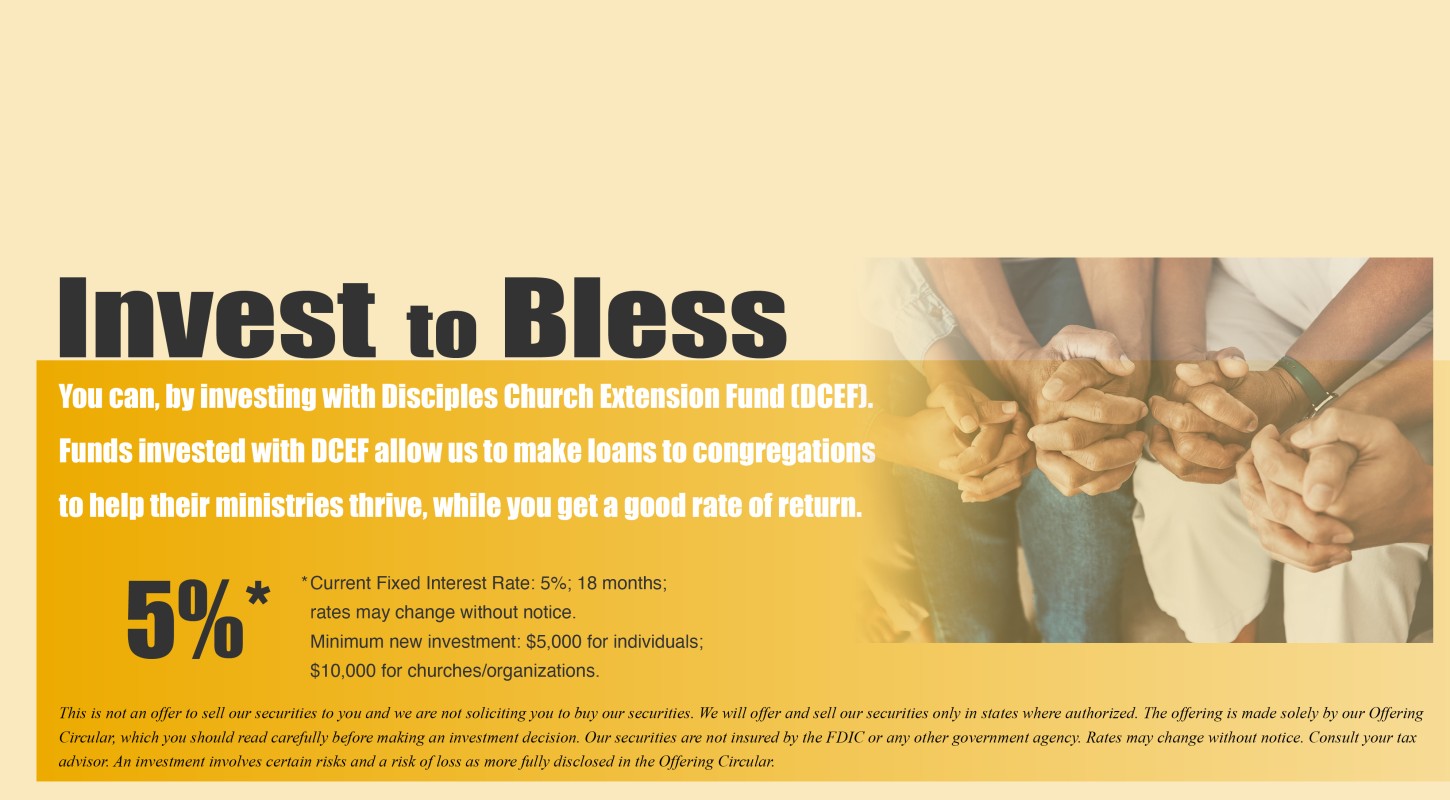

Invest

Your investment with Disciples Church Extension Fund is more than just a financial transaction. It shows how much you value the Disciples ministries you love. Make a socially responsible investment today that not only helps you meet your financial goals, but also strengthens Disciples congregations.

Borrow

Funding your next church project is easier than you think when you partner with Disciples Church Extension Fund. Whether you need money for new construction, repairs and renovations, or other special building projects, we have competitive church loans and refinancing options that are just right for your church.

Fundraise

Congregations often need to raise money—whether it’s for a new building, repairs or renovations to an existing one, or to eliminate debt. Meet your capital fundraising goals faster with guidance from the experienced advisors at Disciples Church Extension Fund.

Give

Your charitable gifts to Disciples Church Extension Fund help congregations thrive and transform communities. Your generosity makes DCEF’s ministry possible. Thank you!